Comenity Bank Credit Cards

That Are Easy To Get Approval For

These store cards are only suggested for those with bad credit who'd like to start repairing their credit. These cards have high interest rates & should be used wisely to get small items at a time & for repairing. I am not an expert, but i would like to tell my experience with doing this.

|

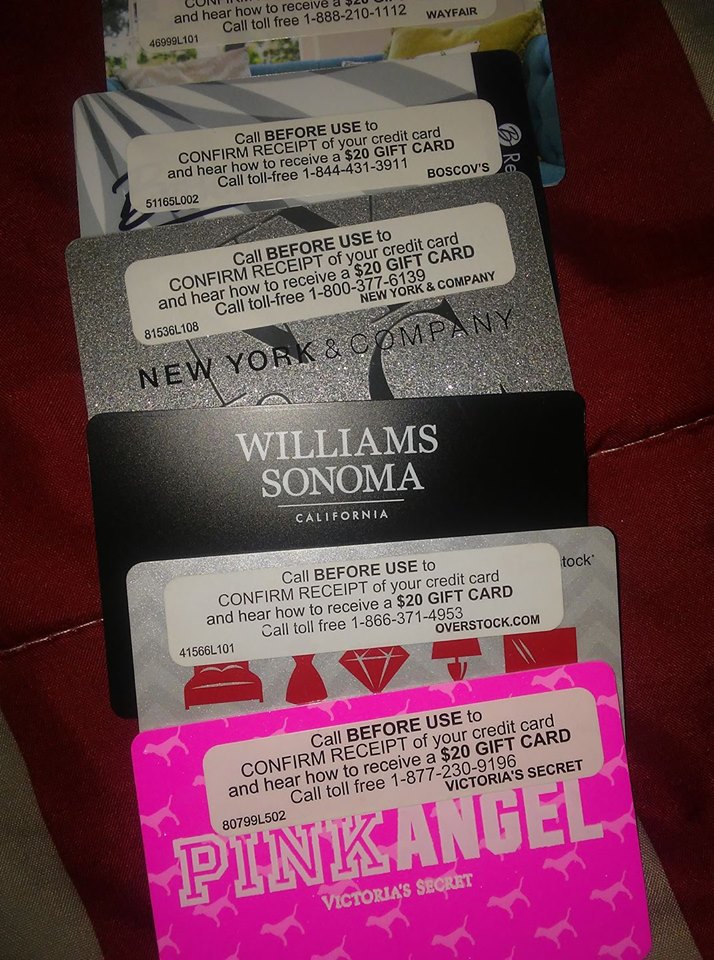

These are some of my actual credit cards from using the shopping cart trick. Worth over $10,000 in credit to start. |

What Is The Shopping Cart Trick? The shopping cart trick is a feature that allows you to get pre-approved for specific store brand credit cards through Comenity Bank & they have over 30 million current customers. These credit cards won't result in a hard pull on your credit report & they don't ask for your full SSN. They only ask for the last four digits. These cards will report to the credit companies & will affect your credit once you start to use them. Rather it be a good or bad, the affect it has on your credit, is your responsibility. Apply For No More Than 2 Cards I don't suggest you do what I did & apply for all of these cards at once. I applied for all of these at once & received them, which triggered a fraud alert & in return I couldn't use my cards yet. I had to send in copies of my state ID, Social security card front & back for both, & a utility bill. |

I was very skeptical & scared of doing that, so I called in &

asked questions & they reassured me that it is normal procedure. I also researched before I sent

it. They only gave me 3 weeks to do it or my credit accounts would be

canceled, so I did. 2 weeks later I received a bunch of letters & my

cards are now all active. These cards, if taken care of properly will lead to you getting a higher credit score & approved for better quality cards with better interest rates if you want, which at that point you can cancel some or all of the store credit cards if you'd like.

How To Use The Shopping Cart Trick?

This shopping cart trick only works with cards from Comenity Bank. There are a few rules you should stick to when trying to do this trick.

- Turn your pop up blocker off if you are using it

- Use a computer not a mobile device

- Go to the store website you want your card be for (Choose wisely)

- Add some items a little over $100 to your cart as a guest

- Begin to check out as a guest & check the box to sign up for promo emails if suggested

- Important Enter your home address the same exact way as shown on your credit reports

- Continue checking out until you've reach the final payment page.

- You should receive a pop up Pre approval credit amount offer before the final page. If not try clicking in the credit card payment box & if this doesn't work, then either the trick is not working for you or you need to try again.

- If an offer pops up for you, accept it & complete the application.

- Remember only enter your last 4 digits of your SSN for soft pull.

List Of Comenity Shopping Cart Trick Credit Cards

The most easiest cards that people say you can get the trick to work with is Victoria's Secret & Overstock. Visit the websites of the stores below & try the trick (sorry no store links added)

- Abercrombie & Fitch

- Ann Taylor

- Brylane Home

- Buckle

- Coldwater Creek

- Express

- Gamestop

- HSN (you need to go to the every end of the check out process before it’ll appear)

- J.Crew

- Jessica London

- JJill

- King Size Direct

- Loft

- Motorola

- My Points

- New York & Company

- One Stop Plus

- Overstock (while it does ask for your full SSN, it should still be a soft pull). This card usually gives a nice high limit and automatic credit limit increases are regular.

- Romans

- Sportsman Guide

- Venus

- Victoria’s Secret ( can be used at Bath & Body Works too)

- Wayfair

- Williams-Sonoma

- Woman Within

Like This Page ?

How To Cancel These Store Cards Properly

Cancel these cards properly once you've decided that you're done with them.

What You’ll Need:

The personal information that you need is:

- Name

- Phone

- Email

- Address

- Social Security Number

- Credit card information

- Access to a phone Reason for canceling Bank account associated with account

Steps to Cancel:

Pay off any remaining usage of your card balances online. You will need to have a $0 balance before you cancel your card.

Call the customer care team for the card you'd like to cancel.

Once you are connected with a Care team representative, tell them that you'd like to cancel your store credit card. The Care team representative may ask you why you want to cancel your credit card. Explain the reason and tell them that you would like to immediately cancel.

Write down the name of the representative you spoke to and (if possible) a confirmation number. Before you get off the phone ask the Care team representative if there’s any associated charges for canceling this card. Once you’re canceled, make sure you review your bank statement associated with the account 30 and 60 days after cancelling to make sure you don’t see any other charges coming from the store account on your statement. Once you're in the clear, cut up your card and throw it away.